Inexpensive insurance plan solutions can be a precedence for Lots of individuals now, Specially as the price of residing carries on to rise. No matter whether you’re in search of wellness, vehicle, property, or existence insurance policy, acquiring affordable alternatives devoid of compromising on coverage is key. Allow’s dive into the entire world of inexpensive insurance policy options and take a look at how for making sensible options when it comes to preserving oneself as well as your family members. You could be thinking, How could you strike the best harmony between cost and high quality? Let’s break it down.

Once you’re on the hunt for inexpensive insurance methods, one of several initial matters to take into account is your certain wants. Do you think you're seeking a little something simple, or do you want extra comprehensive coverage? Insurance plan procedures will vary extensively in rate based on what they address. By way of example, wellness coverage premiums can vary according to your age, wellness situation, and the sort of coverage you involve. By being familiar with your requirements upfront, you can begin narrowing down the options that in shape your price range.

Yet another important component in finding very affordable coverage alternatives is comparing multiple companies. You wouldn’t purchase a auto without take a look at-driving a few products, ideal? Likewise, when looking for coverage, it’s necessary to get rates from distinct insurers. Insurance plan corporations normally give distinctive charges, discount rates, and Added benefits, so evaluating them aspect by aspect will help you find the finest offer. Don't forget, just because just one insurance provider is featuring a cheaper price doesn’t suggest it’s the most beneficial benefit—try to look for procedures that give you the most bang in your buck.

Insured Solutions Can Be Fun For Anyone

Have you at any time listened to the phrase “you have Whatever you pay for”? On the subject of coverage, that’s one thing to remember. It may be tempting to go for the cheapest possibility available, but when it leaves gaps with your protection, you might be placing oneself up for economical hardship down the road. Inexpensive insurance policies options are about extra than just very low premiums—they should give complete security in the event of emergencies. Usually browse the good print to make sure you're not sacrificing high quality for price.

Have you at any time listened to the phrase “you have Whatever you pay for”? On the subject of coverage, that’s one thing to remember. It may be tempting to go for the cheapest possibility available, but when it leaves gaps with your protection, you might be placing oneself up for economical hardship down the road. Inexpensive insurance policies options are about extra than just very low premiums—they should give complete security in the event of emergencies. Usually browse the good print to make sure you're not sacrificing high quality for price.In the event you’re on the lookout for inexpensive car or truck insurance coverage, you may be amazed by the volume of savings accessible. Several insurers offer personal savings for things like becoming a safe driver, bundling multiple insurance policies, or having a vehicle with certain safety options. Right before obtaining a coverage, Verify if any special discounts utilize to you personally. These cost savings can add up after some time, building your premiums a lot more workable. With numerous solutions around, obtaining economical coverage options for your automobile doesn’t should be a headache.

How about well being insurance policies? It’s The most important varieties of coverage, nevertheless it’s usually the most costly. Nevertheless, there are ways to discover inexpensive wellness insurance plan options. One particular option is usually to examine govt-backed courses like Medicaid or perhaps the Economical Treatment Act (ACA) Market, which supply subsidies determined by cash flow. Even though you don’t qualify for these courses, lots of non-public insurers have spending budget-pleasant programs with reduced rates and superior deductibles. These plans may be an incredible alternative in the event you’re generally nutritious and don’t anticipate to want many professional medical treatment.

One more idea for finding inexpensive insurance coverage alternatives will be to increase your deductible. The deductible is the quantity you pay back from pocket in advance of your insurance coverage coverage kicks in. By picking an increased deductible, you'll be able to reduce your every month premiums. Naturally, you’ll want to make sure that you might have adequate price savings put aside to protect the upper deductible if wanted. This method can do the job specifically perfectly for people who are cozy with some danger and don’t anticipate Repeated statements.

When looking for economical insurance plan solutions, contemplate your Way of life And the way it has an effect on your premiums. One example is, should you’re a non-smoker, you may pay out much less for life or overall health insurance. Equally, your own home coverage rates may very well be decrease if you reside in a secure neighborhood with low crime prices or have safety features like a household alarm technique. Put simply, getting ways to scale back hazard may also help lessen your premiums. It’s all about demonstrating insurers you’re a reduced-hazard policyholder.

Let’s talk about lifestyle insurance for the second. Many individuals postpone buying lifestyle insurance plan mainly because they Believe it’s as well high-priced, but there are inexpensive choices accessible. Term daily life insurance coverage, For example, might be drastically cheaper than entire existence insurance plan. With term daily life coverage, you’re lined for a certain period—say, twenty or 30 yrs—as opposed to for the overall life. When your Principal issue is furnishing for your family while in the party within your untimely Dying, expression existence may very well be A reasonable Alternative that gives you assurance.

Homeowners insurance policy is yet another space the place affordability matters. You’ve labored not easy to invest in your house, and preserving it is very important. On the other hand, household insurance policies premiums is often large, especially if your property is located in a very disaster-vulnerable spot. One way to Visit website reduced your rates is always to improve your house’s safety by including characteristics like smoke detectors, burglar alarms, or fireplace-resistant components. Insurers may reward you with lessen fees if you take these safety measures. The same as with other kinds of coverage, becoming proactive in lowering risk may result in extra reasonably priced premiums.

The Definitive Guide to Insurance Portfolio

One error Lots of individuals make when purchasing for very affordable coverage answers is failing to assess their protection wants consistently. With time, your preferences may modify, and what was at the time an enough policy could possibly no more supply the safety you may need. Such as, should you’ve compensated off your car or residence financial loan, you might be ready to cut back your coverage and decreased your premiums. It’s generally a good Know the details idea to review your guidelines annually and make changes as important to keep the insurance plan cost-effective without having sacrificing coverage.On the earth of affordable insurance options, customer support must also Engage in a substantial function in your decision-making system. It’s not just about locating the cheapest rate—it’s also regarding how the insurer handles statements, responses concerns, and supports you if you need it most. Research reviews and ratings of possible insurers to get an plan of their track record. A great insurance plan is ineffective if the business offering it is actually difficult to perform with through annoying cases.

Insurance For Children for Dummies

There’s also the option of bundling your coverage insurance policies to save cash. A lot of insurers offer you special discounts if you buy many different types of coverage with them. For instance, you could possibly receive a crack on your vehicle coverage premiums if You furthermore mght buy your house or renters insurance policy through the exact provider. Bundling is a superb method for anyone looking for inexpensive insurance options, since it allows you to simplify your protection and save cash in the method.

Have you ever ever regarded as the main advantages of going having a substantial-deductible health and fitness strategy? These ideas frequently Find more include lessen premiums and so are a great match for many who don’t anticipate needing frequent professional medical care. By selecting a significant-deductible program, It can save you on rates and put The cash you would've put in right into a wellbeing price savings account (HSA). This will assistance go over out-of-pocket fees if you do have to have healthcare care, all while keeping your insurance policy cost-effective Over time.

What about renters insurance plan? Although not always essential, renters insurance policies is An inexpensive way to protect your possessions in the event of theft, hearth, or other disasters. The cost of renters coverage is usually much lessen than residence coverage, and it can provide you with reassurance recognizing that your belongings are coated. For all those living in apartments or rental homes, this can be a should-have insurance policies solution that doesn’t split the financial institution.

Yet another way to keep your rates reduced is to maintain a fantastic credit rating rating. Quite a few insurers use credit rating scores like a Think about determining premiums, and those with bigger scores are frequently rewarded with reduced prices. Therefore by maintaining a tally of your credit history and enhancing it as time passes, you can obtain far more affordable insurance solutions. If you’re Not sure of your credit history rating, it’s worth examining and getting ways to improve it ahead of searching for insurance.

In conclusion, getting affordable insurance policy solutions doesn’t have to be a frightening task. By finding the time to know your requirements, evaluating choices, and creating smart selections regarding your coverage, you'll be able to protected the protection you will need in a rate that matches your price range. Irrespective of whether it’s auto, health and fitness, lifetime, or household insurance plan, there are many economical possibilities on the market. All it's going to take is a little investigate, flexibility, and an eye for savings. So why hold out? Start off Discovering your reasonably priced insurance plan remedies these days and acquire the protection you should have.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Destiny’s Child Then & Now!

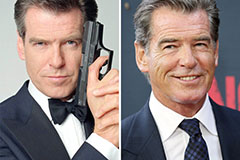

Destiny’s Child Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!